The Problem

Navigating Financial Challenges is a Universal Experience

Every month brings the same cycle - bills to pay, debts to manage, and expenses that never stop adding up. What should be a straightforward task often turns into a source of stress, with receipts piling up and budgets falling behind. Many people want to feel more in control, but the constant effort of tracking makes it hard to stay consistent. BAPP was created to change that, transforming expense tracking into a seamless, automated experience that helps people manage their finances with confidence.

Research

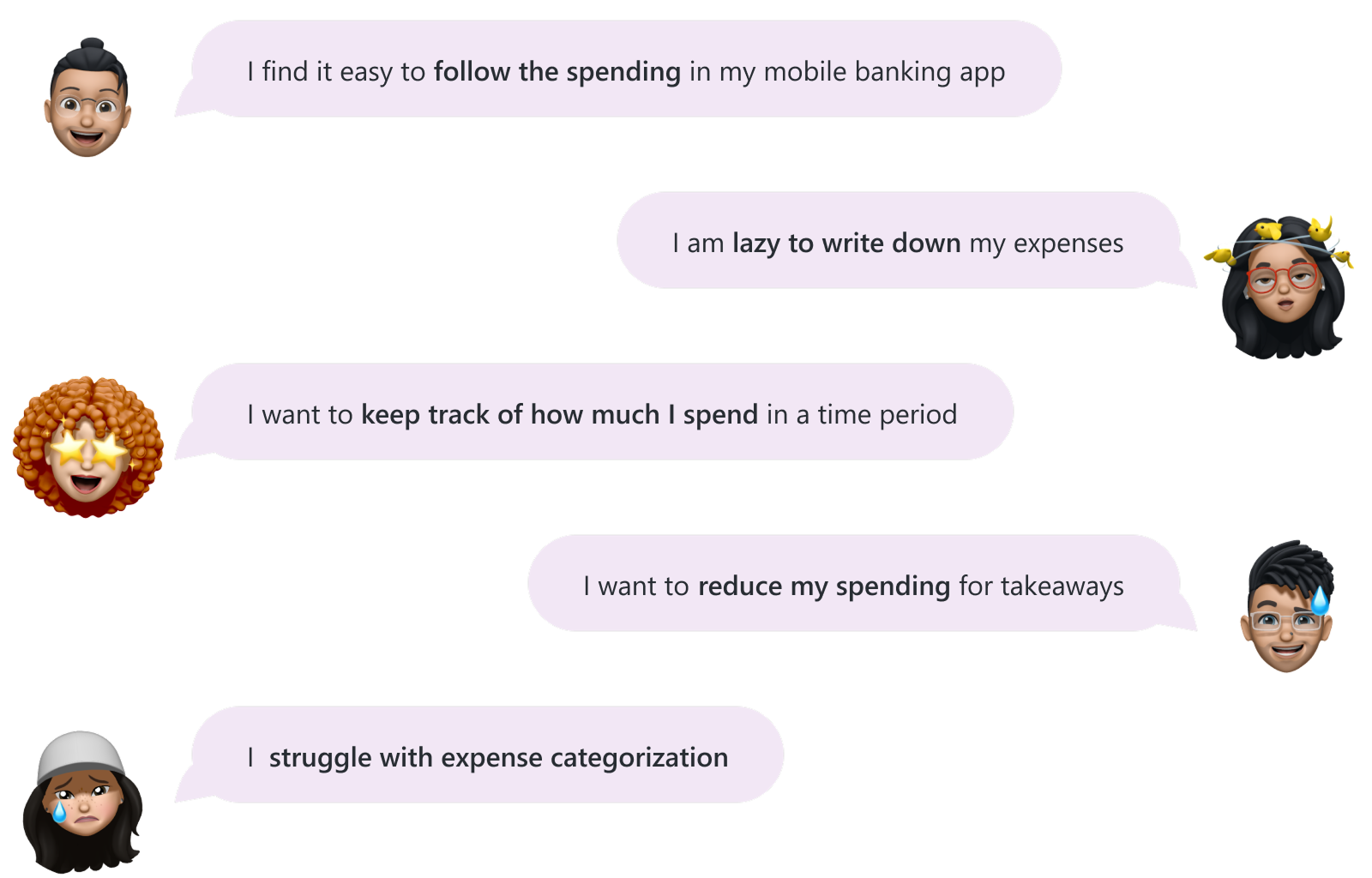

Interviews

To understand how people manage their personal budgets, I conducted 10 interviews. Since financial habits vary from person to person, the focus was on identifying common behaviors and pain points.

Open Banking Integration

With the adoption of PSD2 (open banking), users can now connect their bank accounts directly. This capability significantly enhances expense tracking by reducing manual input, and it became a core requirement for BAPP's design.

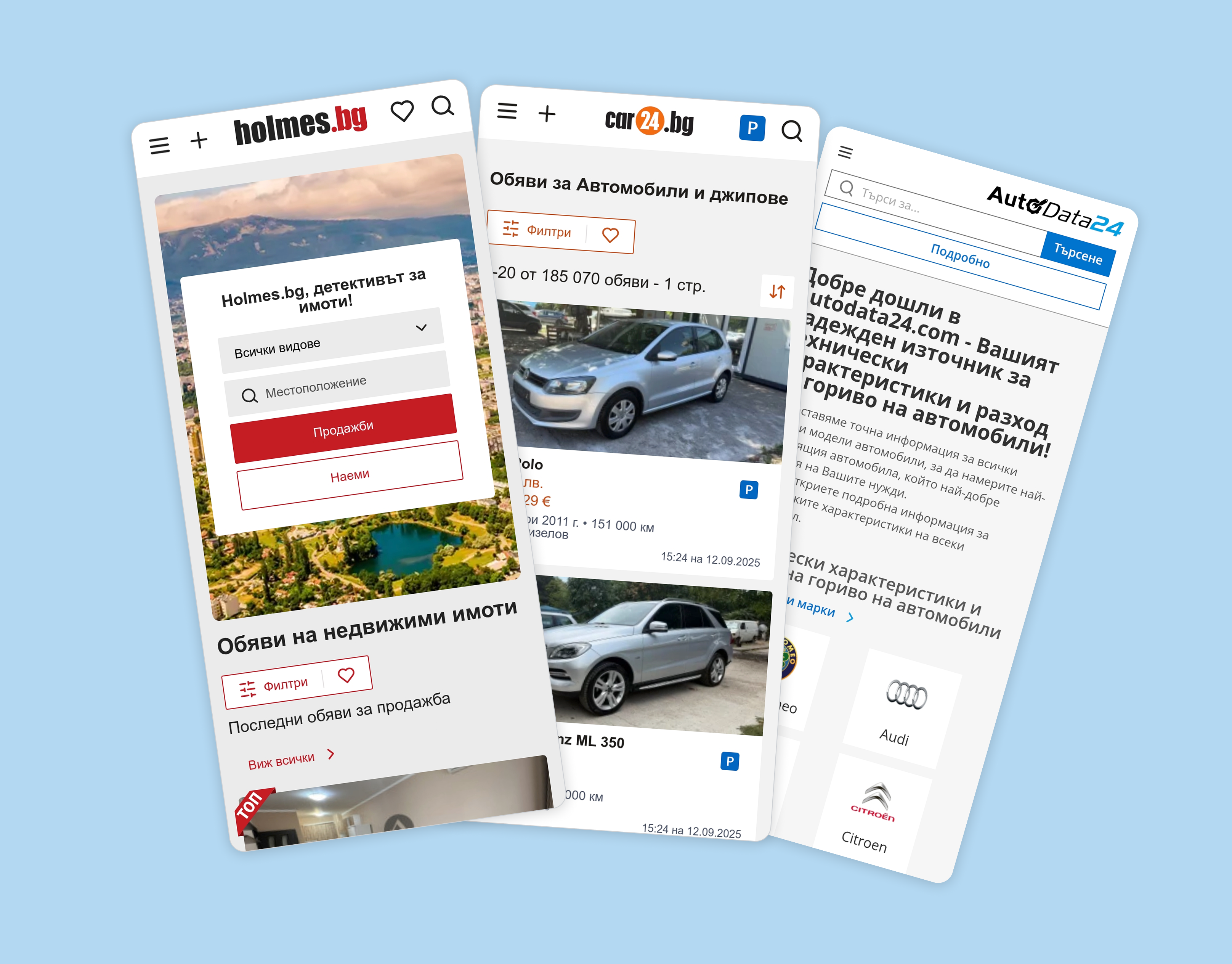

Competitor Analysis

Applications like Mint, YNAB, PocketGuard, and Spendee allow either manual input or automatic syncing from bank accounts. However, they overlook a “middle ground” - efficiently adding physical expenses.

Opportunity: QR Code Scanning

By scanning a receipt's QR code, BAPP instantly pulls in key details, leaving only a quick confirmation from the user. This bridges the gap between digital and physical expenses, ensuring a complete picture of spending with minimal effort.

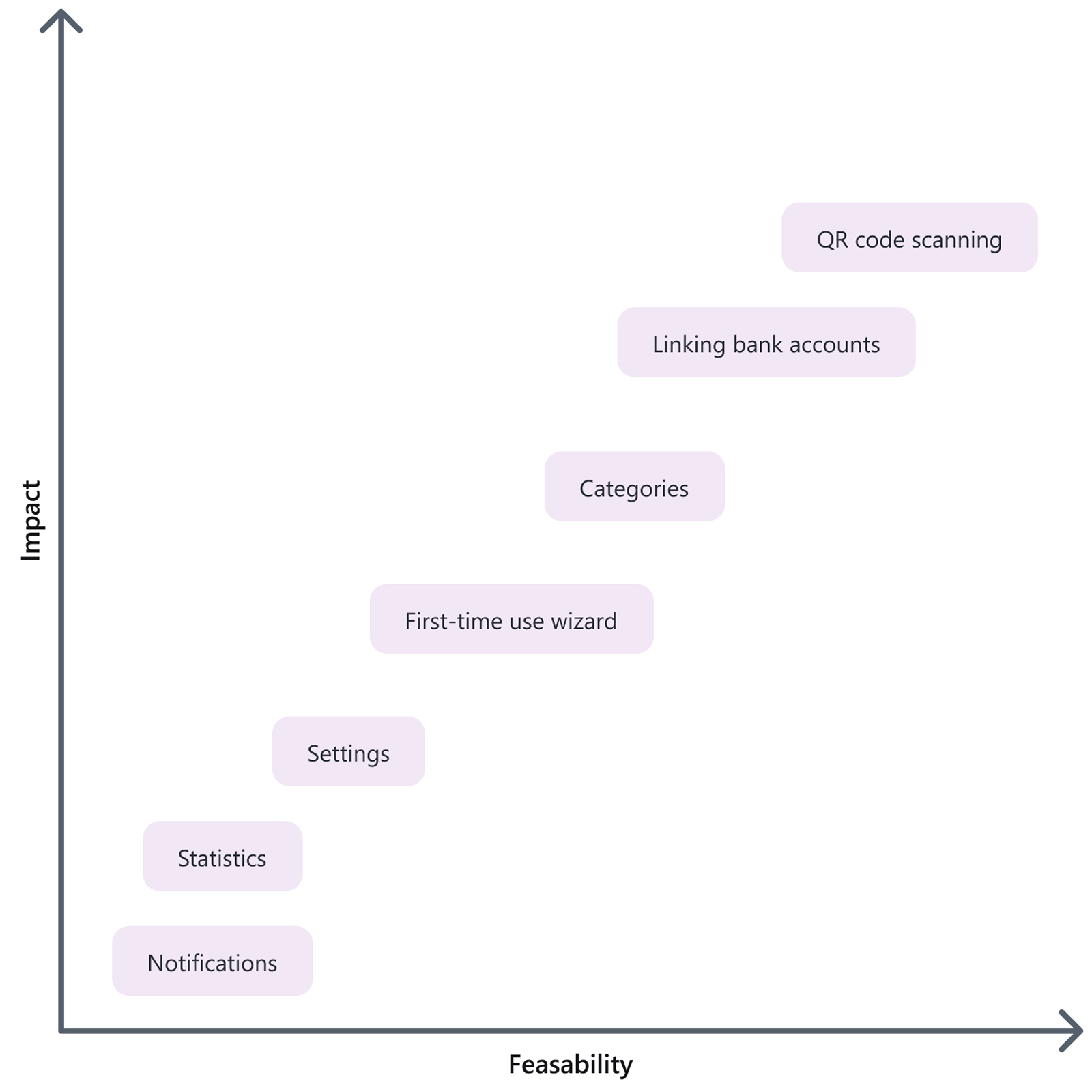

Prioritizing Features

By combining user insights, open banking opportunities, and competitor gaps, I prioritized features based on both impact and feasibility. This ensured the design focused on the most valuable solutions first.

Final Design

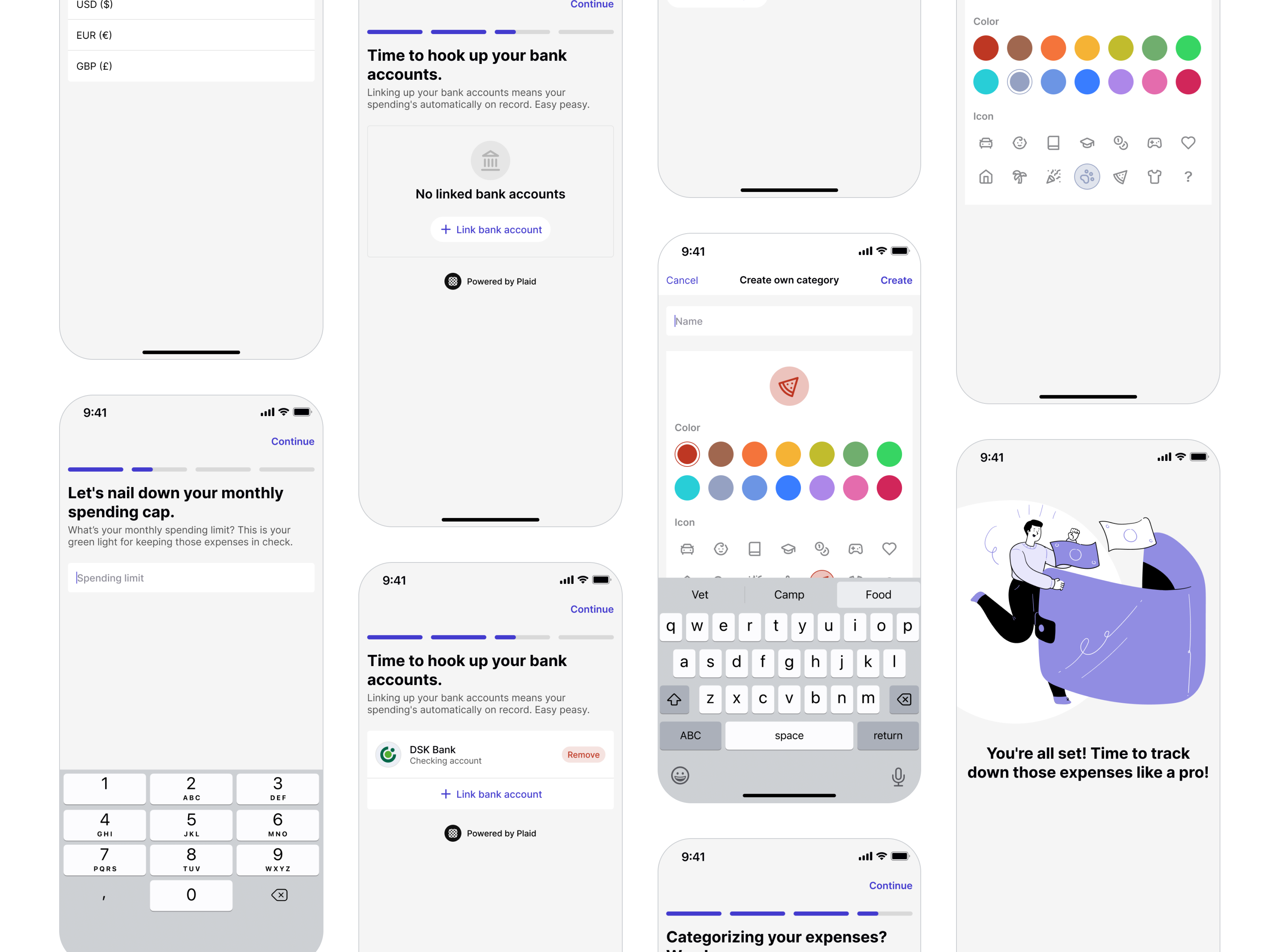

Effortless Onboarding

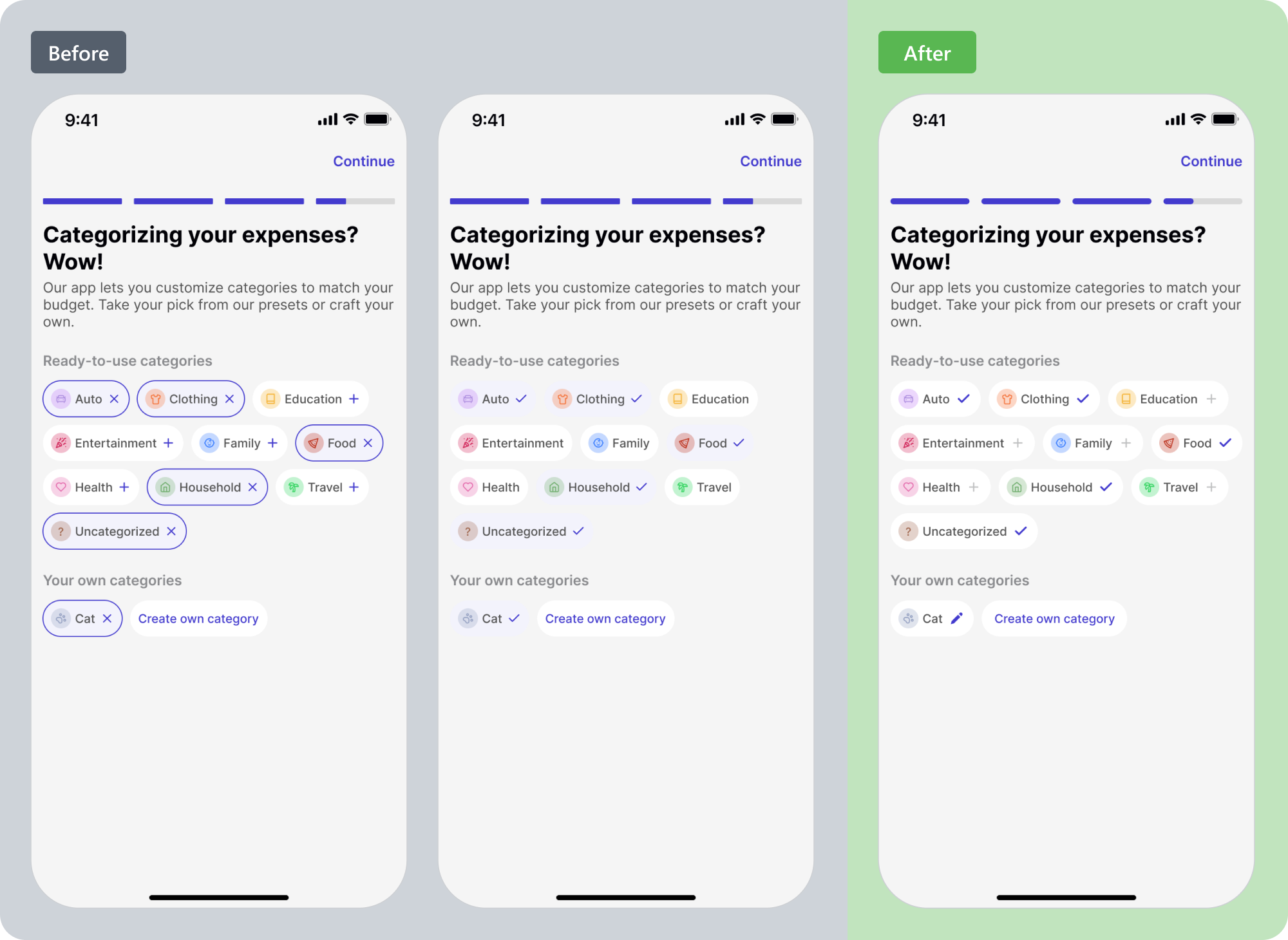

Since people tend to avoid manual data entry, the onboarding process was designed to handle budget setup in one smooth flow. Once completed, users don't need to return and make adjustments. Categorization plays a crucial role in budgeting, so special care was given to designing that step. Still, the first iterations revealed that too many options on a single screen could feel overwhelming, which later informed a more streamlined approach.

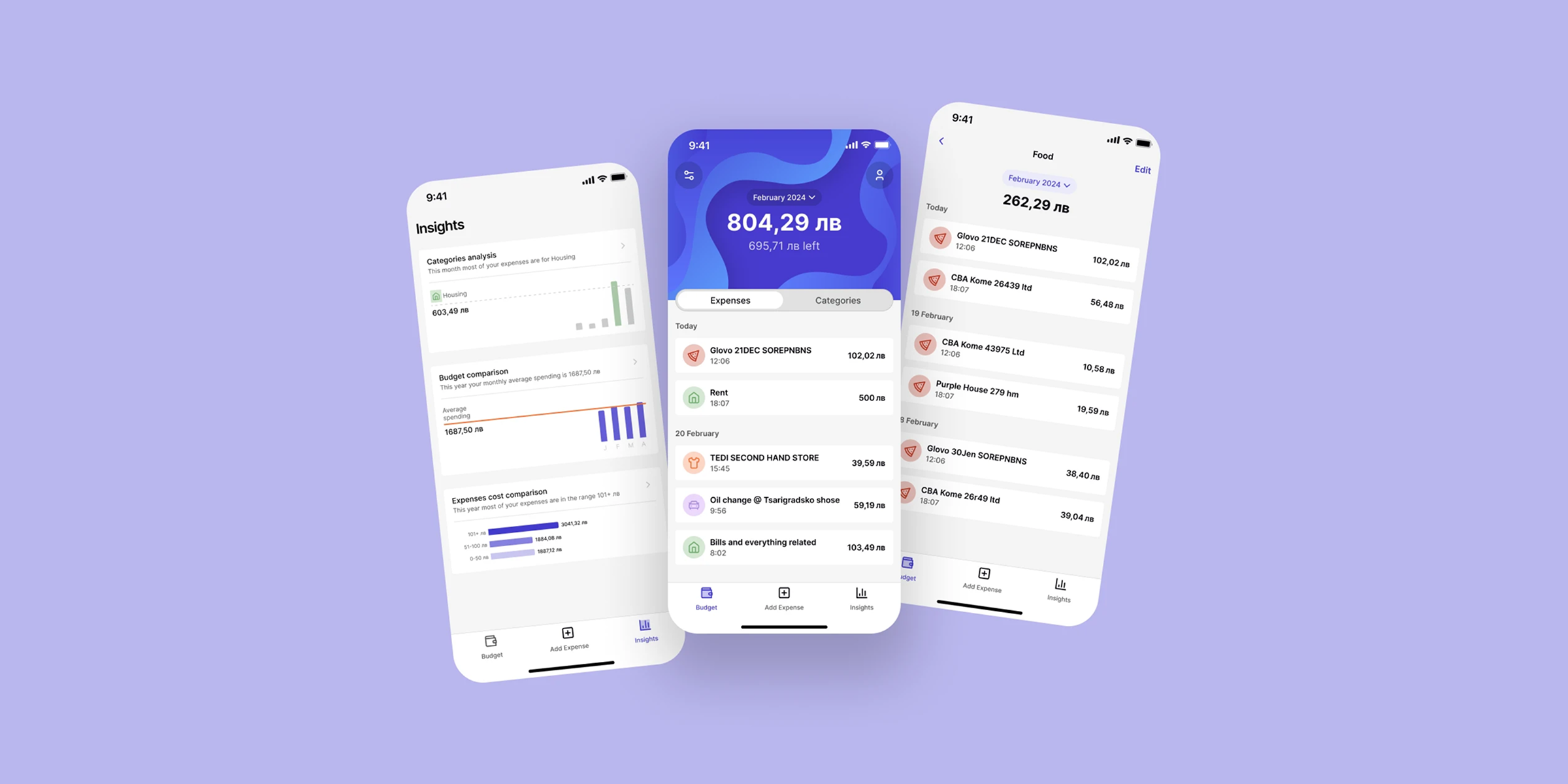

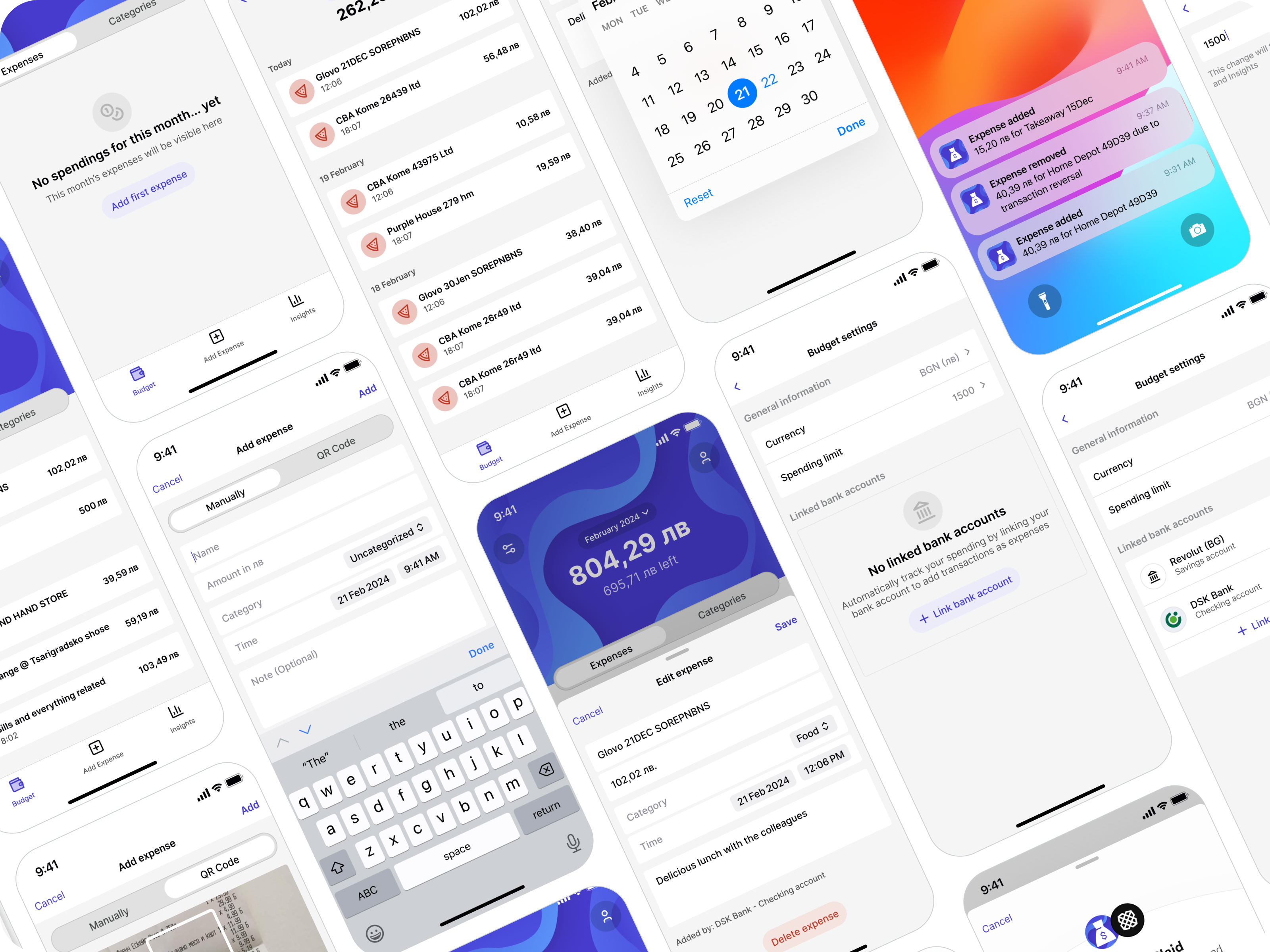

Clear Financial Overview

The core experience centers on giving users a quick understanding of their money. The main screen shows both monthly budgets and recent expenses, ensuring that essential insights are always just one glance away.

Automation First

Linking bank accounts removes the friction of constant manual input. Purchases, refunds, and recurring transactions flow in automatically, giving users confidence that their budget reflects reality without extra effort.

Effortless Expense Capture

Cash payments are harder to track, so receipt scanning was designed as a fast alternative. QR codes automatically pull in key details, leaving users to only confirm or name the expense. This balances convenience with accuracy.

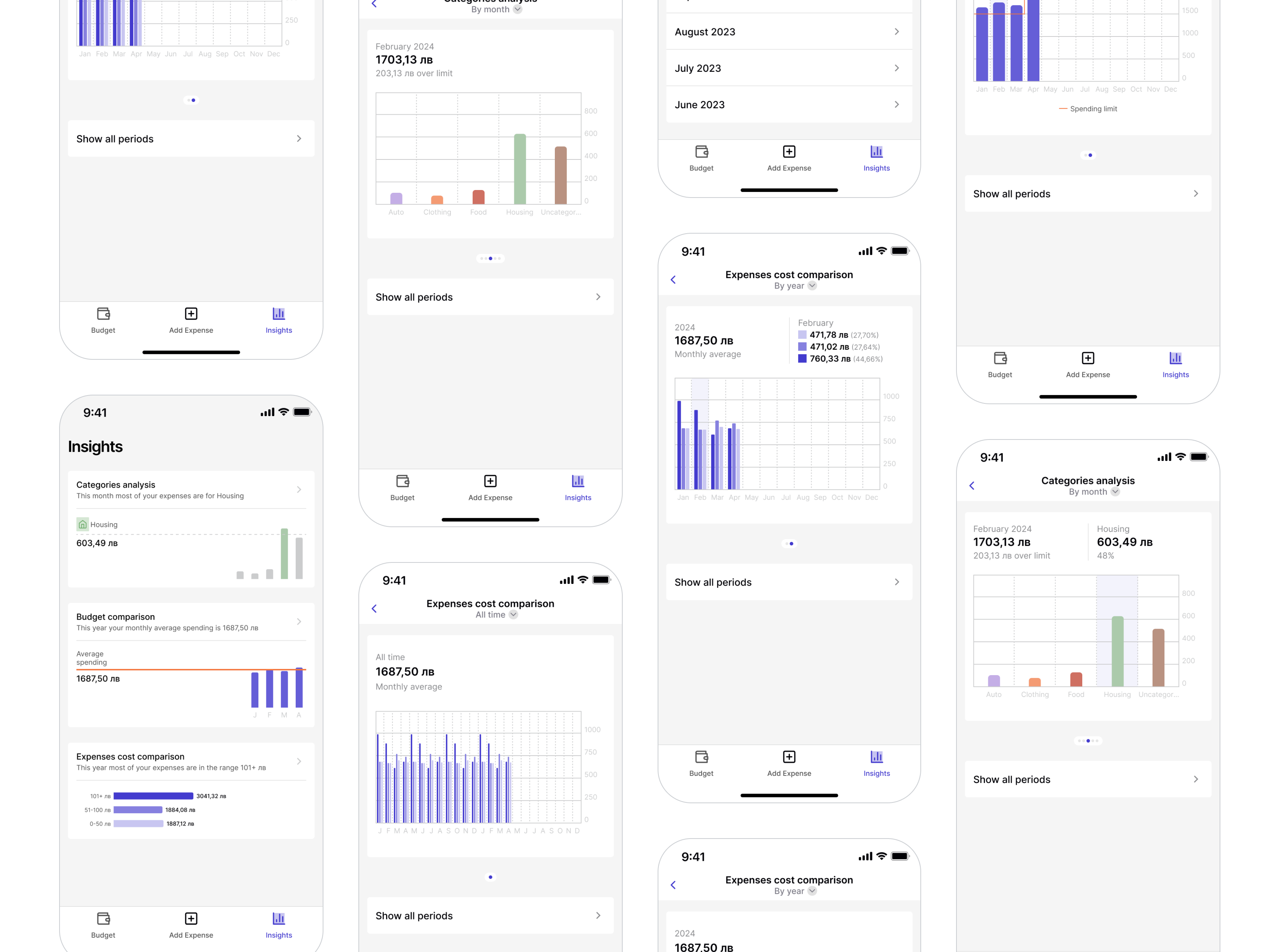

Actionable Insights

Beyond tracking, the app reveals patterns in spending - whether it's a category that consistently dominates the budget, the true impact of small recurring costs, or long-term yearly totals. These insights turn raw data into meaningful guidance for better financial decisions.

The Outcome

Budgeting Made Effortless

BAPP transforms budgeting into a low-effort process by automating expense tracking and reducing reliance on manual entry. Bank account integration and QR receipt scanning streamline the experience, giving users more control with less effort.

Key Insights

- Seamless onboarding - A one-time setup ensures users can start budgeting quickly without repeated adjustments, lowering barriers to entry;

- Effortless expense tracking - Automation and receipt scanning bridge the gap between digital and physical purchases, minimizing stress and saving time;

- Clarity through insights - Visual breakdowns of spending reveal hidden patterns - such as recurring small costs - helping users understand and manage their habits;

- Positioned for growth - By combining open banking with physical expense capture, BAPP stands out among competitors, offering both convenience and flexibility.